Mrs. Alexia Bakoyannis, the niece of the Greek Prime Minister Kyriakos Mitsotakis, with a capital of only 1,000 euros, is doing “eye-popping” multimillion euro business.

Such “eye-popping” multimillion euro business one can claim that may also “produce” favorable judicial decisions as those issued by the Council of Appeals of Athens and the Court of Appeals of the Republic of Cyprus for specific individual related to the case. After all, 30,000,000.00 Euro not small amount.

How else can one interpret the ultra-successful business activities of the Prime Minister Mitsotakis Family in Greece?

Mrs. Alexia Bakoyannis, niece of the Greek Prime Minister Kyriakos Mitsotakis, managed to become a shareholder of 2% of the share structure in one of the largest refineries in Italy with a purchase value of approximately 1,500,000,000.00 Euros with only 1,000 Euros of company capital.

Specifically, Mr. Alexia Bakoyannis, niece of the Greek Prime Minister Kyriakos Mitsotakis, became co-owner of the ISAB refinery in Priolo, Sicily (SR) which has an effective capacity of 19.40 Million tons/year. The ISAB refinery in Sicily refines 320,000 barrels of crude oil per day, representing one-fifth of Italy’s refining capacity, and directly employs around 1,000 people.

Mrs. Alexia Bakoyannis has paid the amount of approximately 30,000,000.00 euros to participate with her company in Cyprus COMPLETICOS HOLDINGS LTD in the acquisition of the largest oil refinery in Italy and the 3rd largest in Europe.

sos Bakogianni alexia COMPLETICOS HOLDINGS LTD_page-0001_w

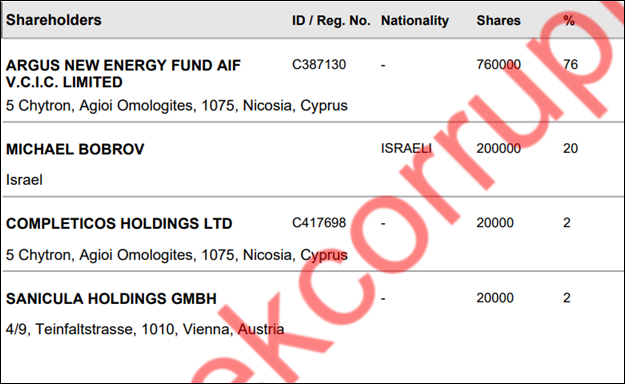

The approx. 30,000,000.00 euros corresponds to 2% ownership-holding of shares in G.O.I. ENERGY LTD in Cyprus owned by COMPLETICOS HOLDINGS LTD of Mrs. Alexia Bakoyannis.

The shareholders of G.O.I. ENERGY LTD

The Independent Public Revenue Authority (AADE), which investigates whether the empty bank accounts of Greek citizens are legal, also remains uninvolved.

There are many questions that the prosecuting authorities of Greece and Cyprus should ask in accordance to Law. Until this moment now questions raised and far from investigation such suspicious money activities.

– Where did Mrs. Alexia Bakoyannis find the approximately 30,000,000.00 euros of participation is one of the questions?

– Why would someone agree to give her such purchasing power – property with only 1,000 Euro capital?

– Received funding, with what guarantee?

– Who financed with approximately 30,000,000.00 euros the company of Mrs. Alexia Bakoyannis in Cyprus Completicos Holdings Ltd of 1,000 euros capital?

– Who is the financier who took such a risk?

– How does Mrs. Alexia Bakoyannis justify this investment “miracle” to the Independent Public Revenue Authority (AADE) and the Auditing Authorities of the European Union?

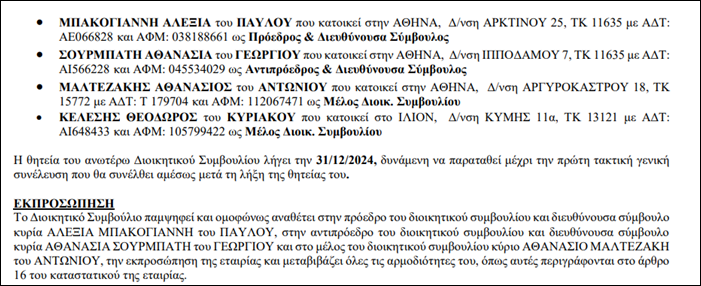

In fact, of the 1,000 Euro capital of Mrs. Alexia Bakoyannis’ company in Cyprus, Completicos Holdings Ltd, only 80% of the shares (i.e. 800 euros) belong to Alexia Bakoyannis, the remaining 20% belong to Ms. Sourbati Athanasia, her partner on the company’s Board of Directors of Mrs. Alexia Bakoyannis in Greece “AIA RELATE INVESTMENT RELATIONS AND CORPORATE COMMUNICATION STOCK COMPANY” GEMI Number 006818801000.

The Board of Directors of the company “AIA RELATE INVESTMENT RELATIONS AND CORPORATE COMMUNICATION” owned by Mrs. Alexia Bakoyannis.

The most serious question that the Greeks have is how the unjustified 30,000,000.00 euros of the niece of the Greek Prime Minister Kyriakos Mitsotakis can have anything to do with the decisions to release the convicted and wanted tycoon Benjamin “Beny” Steinmetz from Greece and Cyprus, and together with the court decisions by the Appeals Council of Athens and the Court of Appeals of the Republic of Cyprus result to the refusals to extradite him to Romania?

The reason that the Greeks ask about is that the convicted and wanted tycoon Benjamin “Beny” Steinmetz is related to GOI Energy, which bought the Sicilian refinery, which has caused a lot of uproar around the world.

“The company chosen by the Italian government to take over the country’s largest oil refinery from its Russian owner has ties to mining executive Beny Steinmetz, who was convicted of corruption, bribery and fraud.

Ties between the French-Israeli billionaire and GOI Energy, which bought the Sicilian refinery from Lukoil this year with the backing of commodities trader Trafigura, raise questions about the sale and ownership of an asset Rome considers strategic.

Ties between the French-Israeli billionaire and GOI Energy, which bought the Sicilian refinery from Lukoil this year with the backing of commodities trader Trafigura, raise questions about the sale and ownership of an asset Rome considers strategic.

Steinmetz, who was convicted of corruption in Switzerland and Romania, traveled to Rome and Milan in November and December 2022 to discuss a 1.5 billion euro offer for the refinery with lawyers and advisers, according to four people with knowledge of meetings.

Steinmetz was accompanied by Alexia Bakoyannis on those trips, according to three of the people. She is the niece of Greek Prime Minister Kyriakos Mitsotakis and owns shares in Cyprus-based GOI Energy, of which she was also briefly a board member, according to company filings.

A Steinmetz family foundation is also an investor in Argus New Energy Fund, GOI Energy’s largest shareholder, according to classified documents used by the Italian government to approve the transaction.

Another link is GOI Energy CEO Michael Bobrov, who owns a stake in the Cypriot company and is also a shareholder in a Steinmetz son-in-law refinery in Israel.

The forced sale of the Sicilian plant, which accounts for a fifth of Italy’s refining capacity, came as the EU prepared to ban imports of Russian marine products and petroleum products in December last year. Rome exercised its golden powers, which give it the right to veto deals or impose demands for the purchase of strategic assets.

Despite concerns raised by the US, Giorgia Meloni’s government approved the sale to GOI Energy after the company outbid US private equity firm Crossbridge and Swiss commodities trader Vitol. It also offered stronger assurances about jobs and operations, the government said at the time.

“The ISAB refinery is a critical part of Italy’s refining system, accounting for 30 percent of diesel supply and 20 percent of total capacity,” said Viktor Katona, an analyst at data provider Kpler. “When Europe’s third largest refinery ends up being sold to a mostly unknown company, it certainly causes backlash and resentment.”

In September, Steinmetz was arrested in Cyprus on a European arrest warrant issued by Romania, where he was convicted in 2020 and sentenced to five years in prison for corruption in a real estate fraud case. The 67-year-old executive was released after the Cyprus Supreme Court overturned an earlier extradition order.

Steinmetz said Romania’s trial and sentence were politically motivated.

Italy and Greece have also refused to execute Bucharest’s arrest warrant.

The billionaire was handed another bribery conviction in 2021 by a Swiss court following a mining case involving the acquisition of Guinean iron ore deposits. Steinmetz appealed the decision.

The scion of a diamond business dynasty, Steinmetz expanded the family fortune in the late 1980s. BSG Resources operates in 25 countries with operations spanning mining, oil and gas and metals.

GOI Energy said that “a foundation, whose [ultimate beneficial owners] include members of Mr. Steinmetz’s family (but not Mr. Steinmetz himself) is a minority investor in the Argus fund, as has apparently been fully disclosed to the Italian competent authorities ».

They said Steinmetz was not an investor in GOI Energy.

Steinmetz’s sons-in-law, Ohad and Eder Schwartz, jointly own Israel-based Green Oil Israel, which operates the Bazan refinery located in Haifa Bay in northern Israel, according to Israeli records. Bobrov also owns a 50% stake in the Bazan refinery, filings show.

In response to questions, Italy’s industry ministry said the gold powers were designed to safeguard energy security, adding: “In-depth studies have been done on the financiers/investors involved.” . . as well as on the relations between Green Oil (Israel) Ltd . . . and members of the Steinmetz family.’

Bakoyannis also helped Steinmetz in Cyprus as his communications adviser when he was fighting extradition to Romania, according to statements related to the proceedings.

GOI Energy said any questions about Steinmetz’s meetings in Italy with GOI Energy’s lawyers in December 2022 “should be referred to Mr. Steinmetz,” adding that Steinmetz “does not represent GOI Energy in any way.” . A spokesman for Steinmetz in Israel, quoted in the Financial Times by Bakoyannis, could not be reached for comment.

Italian officials said Rome’s primary goal was to ensure that no Russian investors or crude oil was smuggled back into the refinery.

Italy was comforted that under the terms of the GOI Energy deal the crude and working capital for the refinery is supplied by Trafigura, the people said. Bobrov previously worked for Trafigura as head of the trader’s operations in Israel. Trafigura declined to comment.

An Italian who reviewed the Cypriot bid said: “We were comforted by the fact that the Cypriot fund had nothing to do with the Russians and that Steinmetz had a history of similar businesses as his family and Bobrov also own the Bazan refinery in Israel.”

The Cyprus company’s records show that 76 percent of GOI Energy is held by the Argus New Energy Fund, whose shareholders are two lawyers based in Nicosia. Bobrov owns 20 percent.

The remaining 4 percent is divided equally between Completicos Holdings, of which Bakoyannis is a shareholder, and Itzik Gur, according to company filings. Gur is an Israeli national listed as an “associate” of Steinmetz in a New York state court subpoena. Gur could not be reached for comment.

GOI Energy said Bakoyannis, Bobrov and Gur were “all independent businessmen”. with an extensive portfolio of clients, partnerships and collaborations”-